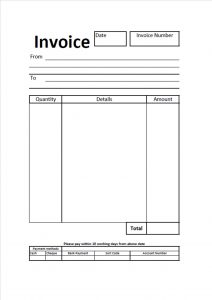

I have been asked ‘what should invoices look like and what should be in them’ quite a few times over the years.

Invoices must by law contain certain information, I have supplied a link to the HMRC guidance page on this matter, for reference. HMRC Guidance – Invoicing and taking payments

I would recommend to sole traders and small business, that the easiest way to ensure your invoices are set out in the right format, is to purchase a basic ‘Invoice’ pad (costs approx. £5) from a stationary company. It should have sequential numbers pre-printed on them, produce a carbon copy for your records and have grid sections that you can then fill in details of the goods or services sold. For about £12, you can order Invoice pads online which can have all of your company details pre-printed on each page, which would save you having to fill that part in each time.

If you would like help in creating a basic invoice for your company, please contact me and I can create a computer template in either Excel, Word or Pages, specific for your company for £5.00 which you can then print off as you need to issue to your customers.

If however, you wish to produce your own paper invoices there are a few rules you must adhere too, in order to meet your legal obligations.

- The word ‘INVOICE‘ must be clearly displayed on your document

- Each invoice must have a unique identification number for each invoice.

- Clearly show your company name, address and contact information.

- The date of the invoice

- The date the goods or services were provided (supply date)

- A clear description of what you are charging for

- The amount being charged

- VAT amount if applicable

- The total amount owed

- You should keep a copy of each invoice produced for your own records as they are a primary document which you need to record your companies sales with.

In addition: If you are a Sole Trader, your invoices must also include, your name and any business name you use, along with an address where any legal documents can be delivered to you if you are using a business name.

Limited Companies must also include the full company name as it appears on the certificate of incorporation, and should you decide to put names of Directors on the invoices, you must include ALL the names of your directors.